In my opinion, the most significant issue with Roblox's stock-based compensation is not necessarily its dilutive impact but its disproportionate size to the firm's sales. Its cash flow per share has fallen dramatically and is nearly negative, meaning the company may need to see equity to offset losses this year.

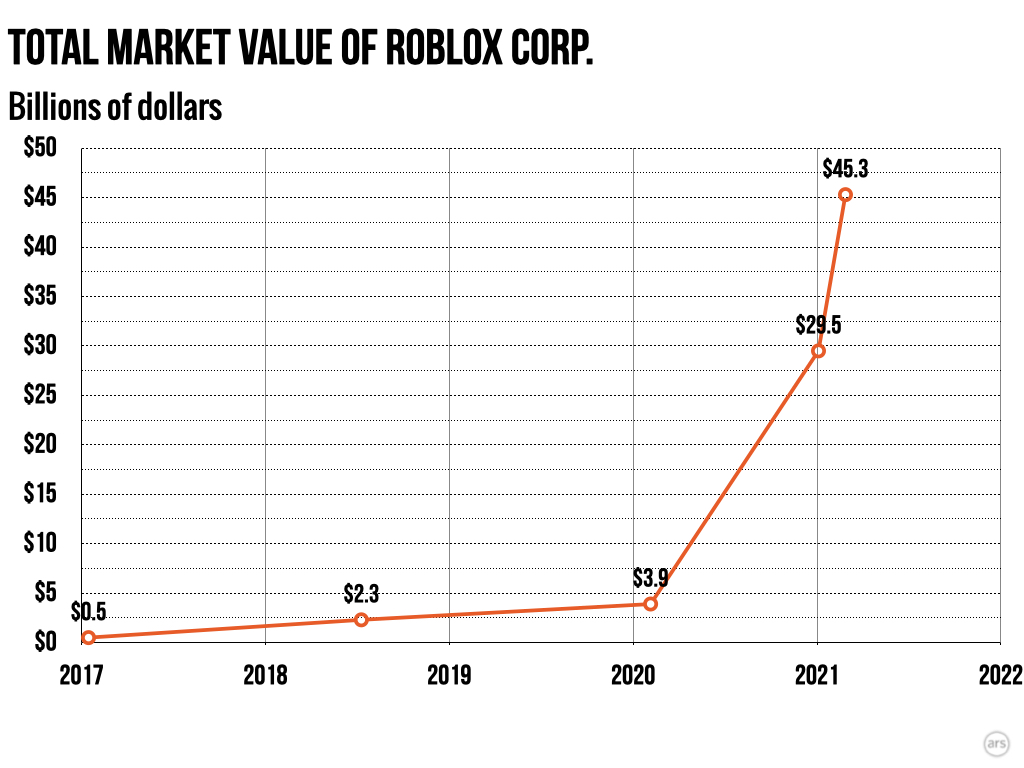

While that figure may not be significant, it could snowball if the firm's stock-based compensation rate continues to climb as its market value trends lower. The company's share compensation rate has risen to $161M per quarter, meaning equity holders will likely be diluted ~3.2% per year at its ~$20B market valuation today. Today, Roblox is an equity-destroying enterprise and has only maintained its cash reserve through a $1B junk-bond sale and relatively large share compensation. To make matters worse, its operating costs have skyrocketed to 133% of total revenue. More recently, this change has caused the firm's total sales per quarter to fall. While it has maintained decent growth since 2020, its booking revenue (from "Robux" sales) per DAU has declined by around 30% since its 2020 peak. Roblox's biggest positive factor is its tremendous market share and viral popularity among its target user base. Even then, RBLX appears very expensive compared to its potential profitability and will likely need a much better income source to maintain its current price. To stay afloat, I believe the firm must prove itself as a profitable enterprise quickly. A rapidly growing company that can never profit has no value (from a DCF standpoint). The company has marketed itself to investors as a growth opportunity since it went public, though its stock has declined considerably since and is trading at less than half of its IPO price. It is a wildly popular platform among children and seems unlikely to expand its North American user base much further, though it still has substantial user growth potential in Asia. In my view, it is evident that Roblox is reaching its upper limit for user growth. If around 28% of its users are in the US and Canada, then around 16.5M or ~27% of the combined 6-17-year-old population in the US and Canada use the platform daily. The platform has grown tremendously over recent years, seeing its DAUs rise from 13.7M in 2018 to nearly 60M in Q3 of 2022. Most Roblox users are children and teenagers, with a staggering 13.4B total gaming hours. The platform obtains around 59M daily active users, with over 4M game developers. Roblox is a game that allows users to create and develop games. One notable example is the gaming company Roblox Corporation ( NYSE: RBLX). The immense growth of digital gaming technologies over recent years has led to significant controversies over the industry's long-term potential.

0 kommentar(er)

0 kommentar(er)